Get the free tennessee application exemption franchise excise taxes form - tn

Show details

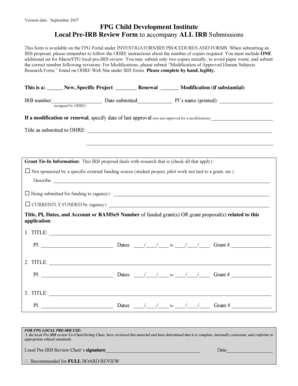

The application for exemption must be filed within sixty 60 days of the beginning of the first tax year for which the entity claims such exemption. The annual renewal th form FAE 183 is due each year by the 15 day of the fourth month following the end of the entity s fiscal year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tennessee application exemption franchise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee application exemption franchise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tennessee application exemption franchise online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tennessee application exemption franchise. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out tennessee application exemption franchise

How to fill out tennessee application exemption franchise:

01

Obtain the necessary application form from the appropriate government agency or download it online.

02

Read the instructions carefully to understand the requirements and gather all the necessary documents and information.

03

Fill out the application form accurately and legibly, providing all the requested details and supporting documentation.

04

Double-check all the provided information to ensure its accuracy.

05

Submit the completed application form along with any required fees or supporting documents to the designated address or office.

Who needs tennessee application exemption franchise:

01

Individuals or businesses who qualify for specific exemptions or privileges from franchise taxes in the state of Tennessee.

02

Those who want to apply for exemption status and avoid paying franchise taxes.

03

Individuals or businesses who meet the eligibility criteria set by the state and wish to take advantage of the exemption franchise.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tennessee application exemption franchise?

The Tennessee Application Exemption Franchise refers to a type of franchise tax exemption available in the state of Tennessee. Under this exemption, certain qualifying businesses that operate as a franchise, such as fast-food chains or retail stores, may be eligible for a reduced or waived franchise tax if they meet certain criteria laid out by the state's Department of Revenue. However, it is important to note that the specific details and requirements for this exemption may vary, so consulting with a tax professional or the Department of Revenue is advised for accurate and up-to-date information.

Who is required to file tennessee application exemption franchise?

Individuals or businesses who wish to claim an exemption from the Tennessee franchise and excise tax are required to file the Tennessee Application for Exemption from Franchise, Excise Taxes, and Business Tax.

How to fill out tennessee application exemption franchise?

To fill out the Tennessee application exemption franchise, you will need to do the following:

1. Download the Tennessee Franchise and Excise Tax Exemption Application form from the Tennessee Department of Revenue website. The form is called "Application for Exemption from Tennessee Franchise and Excise Tax" (Form FAE170).

2. Provide identifying information: Fill in your name, address, phone number, and email address in the appropriate sections of the form.

3. Indicate the type of entity: Choose the appropriate entity type (corporation, partnership, limited partnership, limited liability company, etc.) in Section A of the form.

4. Provide details of the entity: Provide information about your entity's legal name, state of formation, federal employer identification number (FEIN), and the year the entity was formed. If your entity is a disregarded entity, partnership, or trust, you must also provide additional information.

5. Indicate exemption basis: Section B of the form requires you to specify the basis for claiming the exemption. Check the box that corresponds to the exemption that applies to your entity, such as religious, charitable, educational, etc. Provide any additional information or documentation as required by the specific exemption.

6. Provide supporting documentation: Attach any required supporting documents to the application, such as a copy of your entity's organizational documents, IRS determination letter for tax-exempt status, etc. Refer to the application instructions for the specific documentation needed.

7. Sign and date the form: The applicant or authorized representative must sign and date the application in the provided section.

8. Submit the completed form: Make a copy of the completed application for your records and send the original application, along with any required supporting documentation, to the Tennessee Department of Revenue at the address provided on the application form.

Note: It is highly recommended to review the specific instructions and guidelines provided by the Tennessee Department of Revenue for complete and accurate completion of the application.

What is the penalty for the late filing of tennessee application exemption franchise?

The penalty for late filing of the Tennessee Application for Exemption from Franchise and Excise Taxes is $50 per month, up to a maximum of $500.

How do I modify my tennessee application exemption franchise in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tennessee application exemption franchise and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete tennessee application exemption franchise on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your tennessee application exemption franchise, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete tennessee application exemption franchise on an Android device?

Use the pdfFiller mobile app to complete your tennessee application exemption franchise on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your tennessee application exemption franchise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.